Family Business Finds the Perfect Succession Solution with CJG Partners

At a Glance

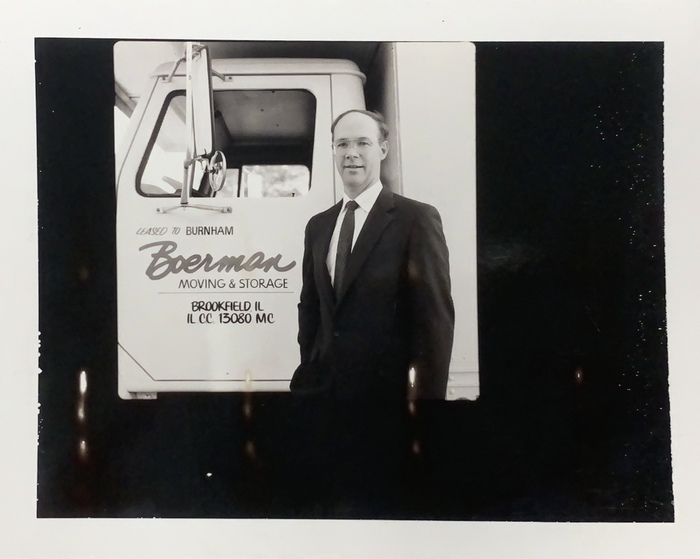

Client: Boerman Moving

Industry: Moving and Storage Services

Location: Suburban Chicago

Owner: Edwin Boerman

Services Provided: Business valuation, tax strategy development, succession planning, retirement planning

ROI: Structured a two-stage succession plan that allowed the business to transition to the next generation while providing guaranteed retirement income for the founder. Created a win-win solution that avoided burdening the sons while ensuring Ed’s financial security.

When Edwin Boerman was ready to retire from the family moving company, his grandparents started in Brookfield, IL, in 1926. He faced a complex challenge. The 3rd-generation owner needed to ensure he had enough income for retirement while keeping the business in the family and setting up his two sons for success as 4th-generation operators.

As a moving and storage company that operates locally and nationwide as an agent for Beacon Van Lines, Boerman Moving handles everything from local and long-distance moving to deliveries requiring “two men and a truck.” After 50 years in the business, Ed wanted a transition that would be “a win-win for both” – providing him with the income he needed without burdening his sons or causing them to fail.

A Strategic Two-Stage Approach

Before the COVID-19 pandemic, Ed reached out to CJG Partners with a specific goal in mind. He provided us with a target retirement income number and asked us to value the business and develop the most tax-efficient strategy for everyone involved.

CJG developed an innovative two-stage succession plan. In the first stage, Ed’s sons purchased the majority of the business while Ed retained a minority share with voting rights. This structure gave the sons ownership security while allowing Ed to maintain control.

The second stage involved Ed’s full retirement, where his sons would buy out his remaining shares. The plan also included the building ownership, creating two income streams for Ed’s retirement.

A Partnership Built on Trust and Communication

What impressed Ed most about working with CJG was our approachable communication style and responsiveness.

“Very casual in a good way. We can easily talk to them. They were available for us,” Ed said. “They weren’t talking about the tax code that we didn’t understand. That was done in the background, and they said, ‘This is what we came up with.’ So they were just easy to communicate with.”

The CJG team also worked seamlessly with Ed’s attorney to ensure all parties were satisfied with the arrangement. “They were kind of in the middle, you know. We also have this attorney that has to get in, and they did very well working with them also.”

Results That Exceeded Expectations

Today, Ed enjoys a guaranteed retirement income and watches his sons take the business “light years past where I had it.” While he admits he could have made more money by selling the company outright, that wasn’t his goal.

“I could have done so much better by just selling the company outright. But that isn’t what the goal was, you know. Want to give my boys a chance,” Ed said. “CJG really listened to what I was looking for and helped me to fulfill that.”

The success of the transition is evident in Ed’s satisfaction with the outcome. “I’ve got a guaranteed income. I go into the office and joke with everybody: ‘Get back to work because you’re paying for my retirement.'”

A Perfect Fit for Mid-Size Companies

When asked what he would tell someone considering hiring CJG, Ed was clear: “Consider it! For a mid-size company, they are perfect.”

Ed pointed out that the responsive service that sets CJG apart continues to impress. “Sometimes you call the attorney, and it takes them a while to get back to you. They’re always right there for us. So that’s nice.”

Ed’s experience embodies exactly what CJG Partners aims to achieve: helping family businesses navigate complex transitions while preserving legacies and ensuring financial security for all parties involved. The firm’s ability to create customized solutions that truly listen to client goals, rather than applying one-size-fits-all approaches, made all the difference for this nearly 100-year-old family business.